As part of the recently signed 2026 New Jersey State Budget, significant changes have been made to the NJ “Mansion Tax.” These changes take effect July 10, 2025, and impact both the rate and responsibility for payment. The expanded Mansion Tax now also applies to certain commercial, farm, co-op, and controlling interest transfers valued over $1M, and includes updated exemptions and refund options.

What’s Changing?

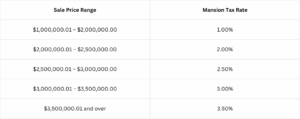

The Mansion Tax will now be paid by the seller (previously paid by the buyer). The tax still applies to real estate sales over $1,000,000, but the rate is now tiered based on the sale price:

Timing & Transition Guidance

Before July 10, 2025 still continue to collect the 1% Mansion Tax from the buyer. If the transaction may be subject to the new tax due to closing/recording timing, collect the difference from the seller and hold in escrow until the deed is accepted for recording.

After July 10, 2025, the seller pays the full Mansion Tax based on the new tiered structure.

Pre-Closing Contract Guidance

If a deal closes on or after July 10, 2025, but the contract was fully executed before that date, and the deed is recorded by November 15, 2025 the buyer pays 1%, and the seller pays the balance of the new rate. The seller may request a refund for the excess tax (above 1%) by applying to the Division of Taxation within one year of recording.

Keep in mind that timing matters; deeds for high-value properties should be recorded immediately to avoid delays or higher tax obligations. Updated forms may be issued by the State. If not available by July 10, 2025, continue to use current forms until further notice.